It can be an interesting idea to bet on Bitcoin price. We say interesting because it can allow for some excellent returns without needing to own crypto but at high risk. The high price volatility leads to that risk, but you can still make sound betting decisions. This article shows you how you can bet on Bitcoin price (going up or down), offers betting tips, and has some more information on the subject.

Understanding Bitcoin and Its Price

Bitcoin is a type of cryptocurrency, and it’s the most popular and highest-value one in terms of its market capitalization.

As a cryptocurrency, Bitcoin does not have any physical representation, such as notes or coins. Thus, Bitcoin and other cryptocurrencies exist only in the digital world. They have value only as digital assets, which you can trade and share with others. You can trade Bitcoin on crypto exchanges or even use it as a mode of payment in the metaverse or at specific retailers that accept crypto payments.

Cryptocurrency is also not the same as fiat currency (the currency we use in our everyday lives, such as the US dollar or the British pound sterling). Governments and various other authoritative bodies regulate fiat currency. Therefore, these bodies can make specific adjustments to prevent a currency from devaluing or increasing its value. That means there is some stability in the value of fiat currency.

On the other hand, cryptocurrency is not regulated by any authoritative body. Therefore, no single actor can have an effect on the price of cryptocurrencies. Instead, some other factors can affect the prices of different cryptocurrencies. Below are some factors.

- Supply and demand, in which a greater demand than the supply increases the value of Bitcoin and other types of crypto

- Social media hype can also significantly affect how people view a specific cryptocurrency and influence their investing decisions

- Increasing competition can also reduce the price of specific cryptocurrencies as people may consider another type of crypto over another

- Availability on crypto exchanges is one factor that may not affect Bitcoin (because it’s readily available on exchanges), but some less popular ones may lose value when they are not available on many popular crypto exchanges.

How Bitcoin Payments Can Work

You should also note that you don’t have to give Bitcoin in whole numbers. For example, if you were to buy a pair of shoes valued at $100, you’d pay the converted Bitcoin equivalent instead.

Let’s assume that Bitcoin (BTC) is valued at $16,800.

So, if 1 BTC is $16,800, then $100 will be calculated as follows.

100 / 16,800 = 0.006 BTC. Crypto exchanges and crypto cards, such as a Coinbase Card, allow you to make transactions in fractions of BTC.

Top Cryptocurrency Exchanges

Crypto exchanges are platforms where people can buy or sell (trade) crypto assets and other digital assets. These assets also include fiat currency. Even if you’re not trading on these platforms, you can determine the price of a specific cryptocurrency there. With that said, here are some of the most popular crypto exchanges according to Forbes.

- Kraken

- Gemini

- com

- KuCoin

- Coinbase

Forbes chose these platforms because they have basic and advanced trading features, educational resources, exceptional customer service, a range of security options, and so on.

Bet on Bitcoin Price

Can I bet on the Bitcoin price? Yes, you can bet on the Bitcoin price going up or down. As detailed below, you can do so through spread betting and other forms.

Bitcoin Spread Betting

Bitcoin spread betting is an excellent way to bet on cryptocurrencies without owning these digital assets. This type of betting is about making wagers on whether the price will go up or down. It does not have to do with the price reaching a specific number. Instead, the direction of the price is essential. Thus, you must make predictions based on whether the prices increases or decreases. You will win your bet and make a profit if your prediction is correct.

Points are an essential part of spread betting. Allow us to explain. A point is a form of measurement that signifies how much the price of a digital asset changes. Let’s consider an example to understand it in greater detail.

However, before that, please note that if you bet on Bitcoin falling, i.e., the price decreasing, then you’ll take a short position. A short position is a term that references the direction you think the price will head.

On the other hand, you’ll take a long position if you bet that the price of Bitcoin will increase over a specific period.

How to Spread Bet on Bitcoin Price

Here’s an example of how to bet on bitcoin going down through spread betting.

Let’s say that a betting website offers spread betting for the Bitcoin price. Let’s assume that the price is $20,000 for 1 BTC.

Now, bettors must predict the price’s direction in one month. To measure that movement, the betting website will use the point system. Thus, they may choose to set 1 point to $100 change.

Let’s assume you predict that the price will decrease, taking a short position. Moreover, you place a wager of $10 per point.

After one month, the price of 1 BTC changes from $20,000 to $19,000. Thus, you were correct in your prediction. So, what are your earnings? Let’s consider these numbers.

- Price change: $1,000

- Total points based on price change: 1000/100 = 10

- Your bet per point: $10

- Your earnings: $10 x 10 points = $100

Therefore, spread betting is an excellent option to make money off Bitcoin price changes without owning a single asset.

How to Bet Against Bitcoin

There are some ways to bet against Bitcoin by owning this digital asset. We would not readily recommend it because this asset is highly volatile. Nevertheless, we’ll go over two popular methods.

- Margin trading: You can use this method to borrow Bitcoin assets to make bets on whether the price increases or decreases. So, you use only a fraction of your own assets because the borrowed assets are greater.

- Short selling: In this case, you sell your Bitcoin assets when the price is high and buy more when the price is low. You can sell them again when the price increases. The difference is your profit.

Crypto Betting Tips

We understand that betting on something new and unfamiliar can be challenging. So, here are some crypto betting tips to help you make informed decisions regarding your bets.

Start with Low-Value Wagers First

As with any form of betting, getting used to the whole betting scene first is always a good idea. Despite how much research you do on a type of betting, nothing can replace lessons learned from first-hand experience. However, you should avoid making your initial learning experiences high risk. So, try to start with low-value wagers first so that you help reduce your risk with your bets.

Look at Predictions By Experts But Do Not Rely Solely on Them

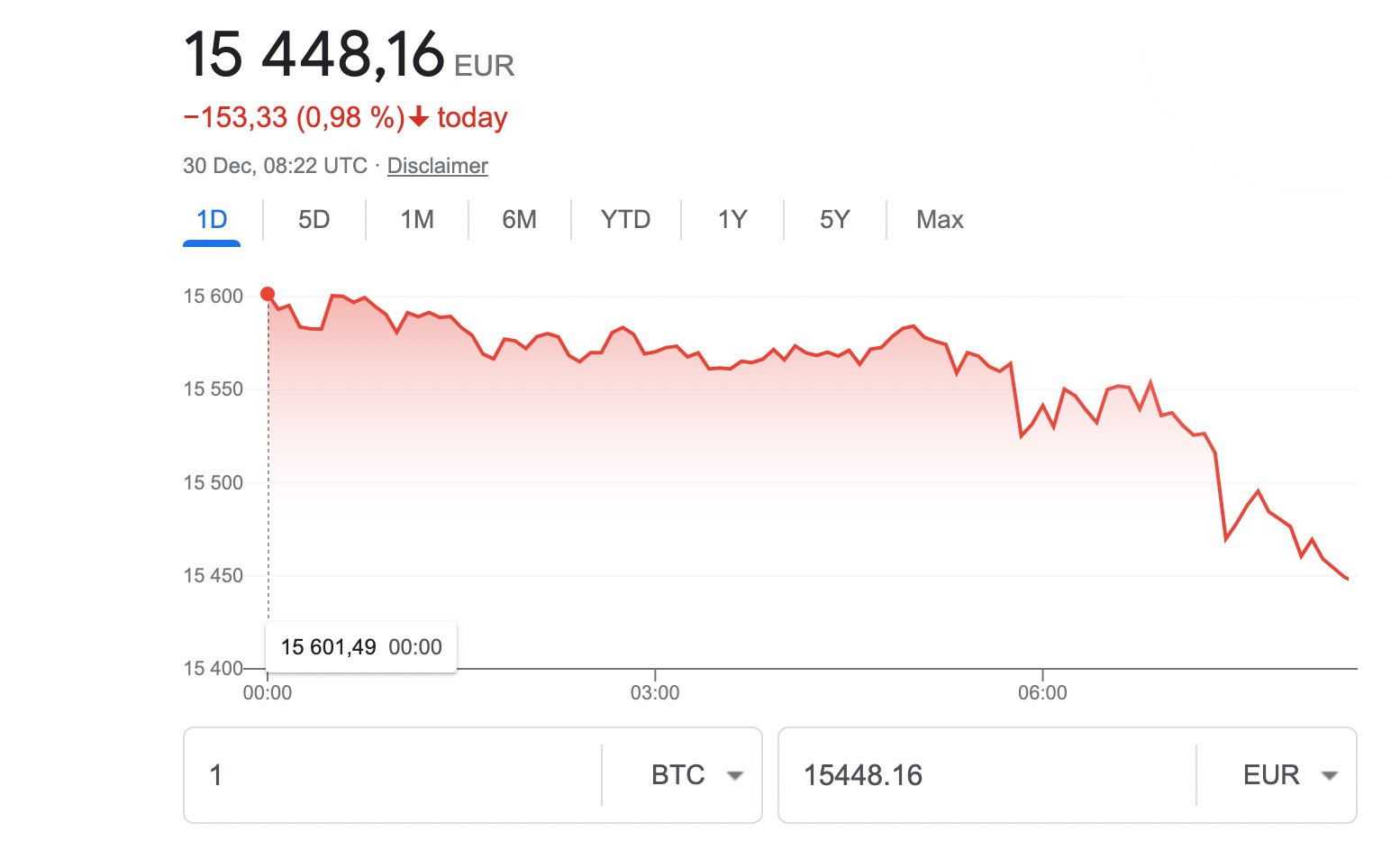

Something everyone should understand is that the value of Bitcoin is highly unpredictable. You can look at its price trajectory in the past couple of years to get a clear idea of that. At the start of 2020, it was at about $7300 for 1 Bitcoin (BTC). However, the price varied significantly throughout that year, reaching over $32,000 by the end of the year. The price then increased significantly again in 2021, touching a peak of $64,400 on November 12, 2021. In just over a month, the price dropped again, reaching just over $47,000 by the end of the year. The price continued to fluctuate throughout the rest of 2022, and it was over $16,800 at the time this article was published.

Examples of Predictions by Experts That Failed

Many professionals who work closely with crypto don’t get their predictions correct. For example, at the end of 2021, Kate Waltman, who is a certified public accountant and Certified Cryptocurrency Expert (CCE) in New York, claimed that various crypto-focused educators predicted that Bitcoin price would be $100,000 by the first quarter (Q1) of 2022. They also claimed that the price could increase before Q1. However, we now know that was not an accurate prediction. The highest the price went to was over $47,400 in that period. The Token Metrics founder and Bitcoin investor Ian Balina made another prediction that failed. This business is a crypto media and research company. Thus, Balina’s prediction would have some weight and value. He had estimated that the Bitcoin price would peak at $75,000 at some point in 2021. The highest was $64,400, as mentioned above. Again, not an accurate prediction.

So, even if you spend considerable time and effort researching Bitcoin price predictions, there’s a good chance your predictions will not go the way you planned. What that means for you is that you’re choosing a very risky form of betting.

Consider the Duration of the Price Change

If your bet involves measuring the price over a long period, you may consider betting on the price decreasing. This is especially true if you see how the current Bitcoin price has dropped this year. However, the price continues to fluctuate significantly in short periods. So, even if the general direction is downward, it may still go high first and then come back down.

In short, depending on the market and the recent trends in crypto, it may be a safer bet to consider wagers that range over a relatively long period, such as a couple of months or more.

Consider Betting on the Stock Market

If you want to engage in spread betting, it may be better to bet on the stock market instead of the Bitcoin price. The stock market is also with its own risks, but stock prices may not be as volatile as crypto prices. Thus, you can consider it as a potentially less risky option to help you familiarize yourself with spread betting.

Quick Questions and Answers about Betting on Bitcoin Price

Below are some quick questions and answers about betting on Bitcoin price.

Should I own and know about crypto trading when Bitcoin spread betting?

You don’t need to own Bitcoin spread betting, but we recommend that you know about crypto trading to do so. Doing your homework is always a good idea when you’re betting. Thus, you should know about factors that affect the prices of Bitcoin.

What are the best crypto betting sites?

Some of the best crypto betting sites where you can consider spread betting include the following.

- IG

- Spreadex

- ETX Capital

We picked these websites because they offer a range of betting options, have user-friendly interfaces, and have fairly good customer service.

Is it legal to spread bet Bitcoin?

The answer to this question depends entirely on where you reside. Thus, bettors in the US and Australia cannot legally spread bet Bitcoin. However, bettors in the United Kingdom and other European countries can legally spread bet on the price of Bitcoin.

What does it mean for a price to go up or down in terms of Bitcoin Price?

A price going up means the Bitcoin value increases, meaning it will sell for more money on the crypto exchanges (you will also need to spend more money to buy it). A price going down means the Bitcoin value decreases, meaning it will sell for less money on the crypto exchanges (you will also need to spend less money to buy it).

Is it worth it to bet on crypto?

It can be worth it if you look at a crucial factor. The factor is that you don’t need to invest money in crypto. Bitcoin and other cryptocurrencies are volatile, meaning their value fluctuates significantly. So, investing in crypto can be risky, especially because the margin of the value changes is significant. For example, the Bitcoin price dropped from about $30,100 on June 8, 2022, to about $18,900 on June 18, 2022. In ten days, Bitcoin holders lost over $10,000 for every BTC they owned. In that regard, betting on Bitcoin can be less risky because you are not dealing with such high chances of loss with your wagers (provided you don’t place high stakes).

Should I invest in Bitcoin?

Bitcoin can be a worthwhile investment, especially if you capitalize on its volatility. So, you can purchase some BTC assets when the prices are low and then sell them as they increase. The fact that Bitcoin prices change at such significant margins can be advantageous, allowing you to get significant returns. However, do not forget about the potential risk with this kind of investment and trading.

Final Thoughts

Betting on Bitcoin price may not be the best option for new bettors, but it can be rewarding for crypto experts. That said, you cannot ignore the risk involved due to the fact that Bitcoin prices are not regulated.

read more:

Written by

Written by

Cashback Bonus

Cashback Bonus